Pittsburgh’s banking sector faces an unprecedented wave of sophisticated threats that single-point security solutions simply can’t handle. From the historic financial district downtown to suburban branch networks, financial institutions across the Steel City need comprehensive, multi-layered security approaches to protect assets, customers, and operations.

Banking security threats have evolved far beyond traditional concerns. Today’s criminals use advanced technology to execute complex fraud schemes, often targeting multiple systems simultaneously. Recent industry analysis reveals that banks face significant cybersecurity vulnerabilities, particularly through third-party vendor relationships that create unexpected entry points for bad actors.

The sophistication of modern threats is staggering. Criminals now use technology to duplicate electronic wallets across multiple devices, executing purchases in different geographic locations within minutes. These rapid-fire attacks require multi-layered detection and prevention systems that can identify suspicious patterns across multiple channels simultaneously.

Physical security remains the critical foundation of any comprehensive banking security strategy. For Pittsburgh banks, this means securing everything from main lobbies and teller areas to ATMs, safe deposit box areas, and employee-only sections.

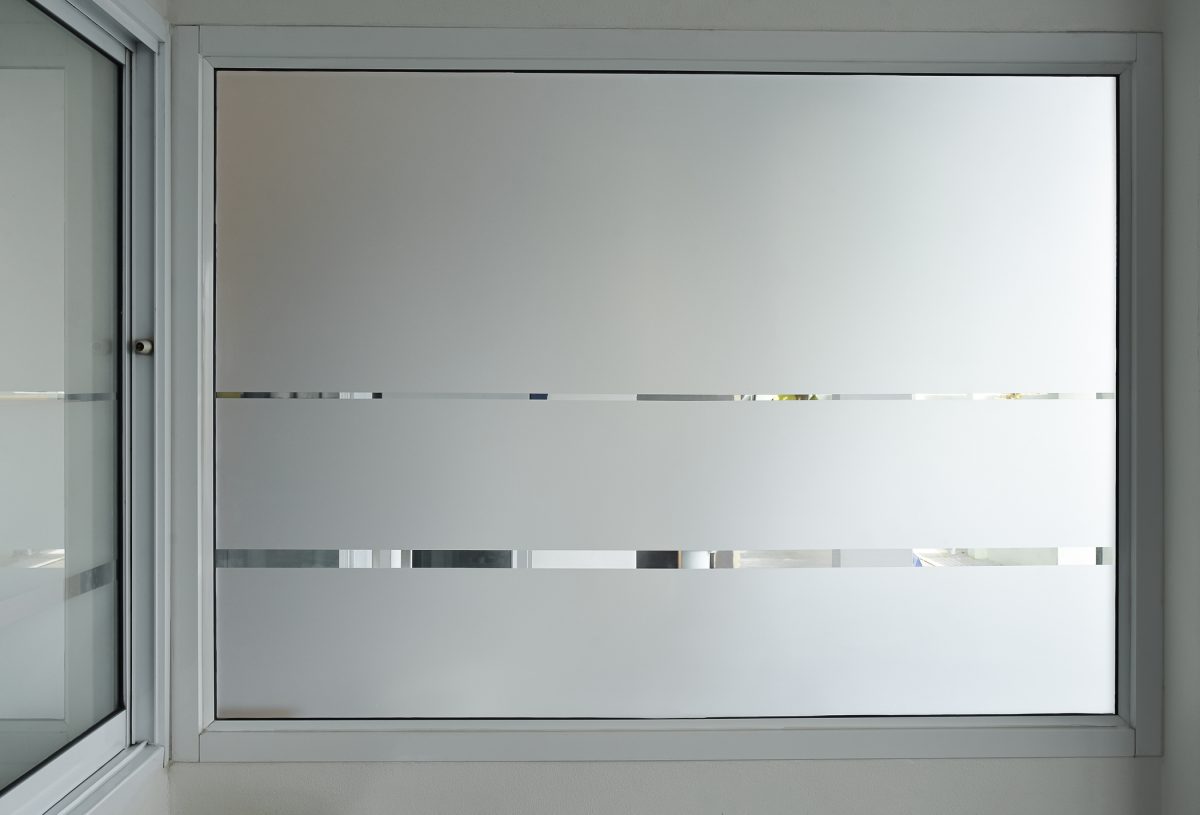

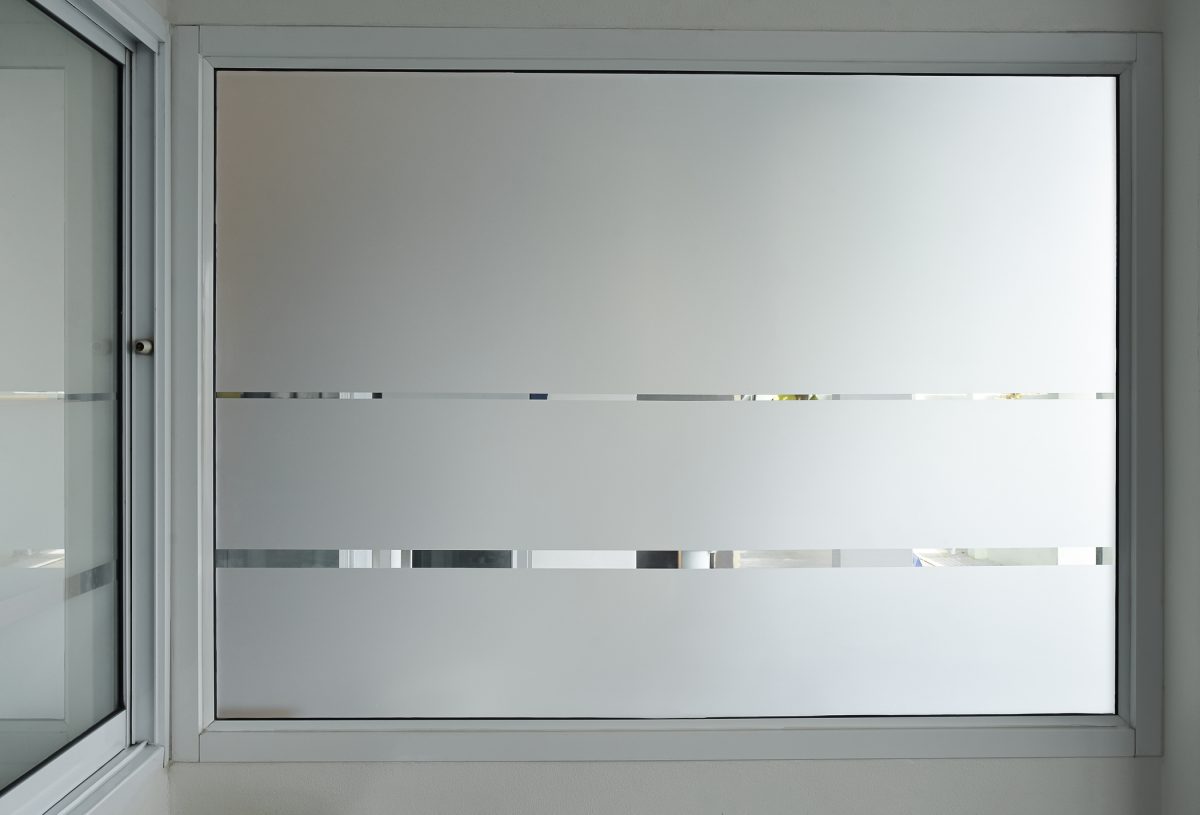

Modern physical security systems integrate multiple technologies working together. High-definition surveillance cameras provide 24/7 monitoring capabilities, while advanced access control systems ensure only authorized personnel can enter sensitive areas. Motion detection sensors, glass break detectors, and perimeter security create overlapping zones of protection that make it nearly impossible for unauthorized individuals to access critical areas undetected.

Smart card readers and biometric access controls add additional verification layers for employees and visitors. These systems don’t just grant or deny access: they create detailed audit trails showing exactly who accessed what areas and when, providing crucial evidence for investigations and compliance reporting.

While physical security protects the building, cybersecurity defenses protect the digital infrastructure that powers modern banking operations. Pittsburgh financial institutions process thousands of transactions daily through interconnected systems that require robust protection against cyber threats.

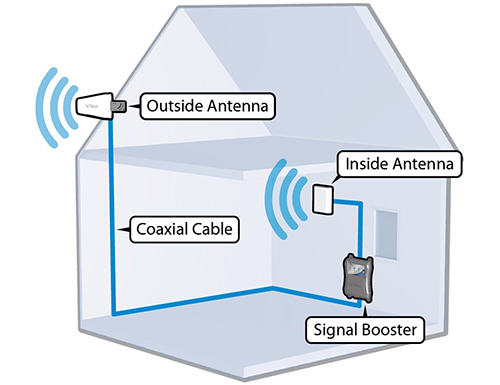

Network security starts with enterprise-grade firewalls and intrusion detection systems that monitor data traffic 24/7. These systems identify suspicious activity patterns and can automatically block potential threats before they compromise sensitive systems. Advanced threat detection uses machine learning algorithms to recognize new attack methods that traditional signature-based systems might miss.

Data encryption protects sensitive information both in transit and at rest. When customer data moves between systems or gets stored in databases, strong encryption ensures that even if data gets intercepted, it remains unreadable to unauthorized parties.

Effective access control goes beyond simple key cards. Modern systems use multi-factor authentication combining something you have (a card), something you know (a PIN), and something you are (biometric data). This layered approach makes it exponentially more difficult for unauthorized individuals to gain access to restricted areas.

Role-based access control ensures employees can only access areas and systems necessary for their specific job functions. A teller might have access to customer service areas but not the server room, while IT staff have system access but not vault areas. These granular controls reduce both external threats and internal security risks.

Time-based access restrictions add another layer of protection. Certain areas might only be accessible during specific hours, with automatic lockdowns outside business hours. Emergency override capabilities ensure authorized personnel can still access critical areas during after-hours emergencies.

Modern video surveillance systems do much more than simply record events. Advanced cameras use intelligent analytics to identify unusual behaviors, count people in specific areas, and even recognize faces of known individuals.

High-definition cameras capture clear images that provide valuable evidence for investigations. Night vision capabilities ensure 24/7 monitoring even in low-light conditions. Pan-tilt-zoom cameras can automatically track movement and focus on specific areas when motion is detected.

Cloud-based storage systems ensure video evidence remains secure and accessible even if on-site equipment gets damaged or stolen. Remote monitoring capabilities allow security personnel to view live feeds from multiple locations, enabling rapid response to emerging situations.

Sophisticated alarm systems integrate multiple detection methods to provide comprehensive coverage. Door and window sensors detect unauthorized entry attempts, while motion detectors identify movement in areas that should be empty.

Silent alarms allow staff to discreetly signal for help during robberies or other threatening situations. These systems can automatically notify law enforcement and security companies without alerting potential criminals.

Environmental monitoring detects threats beyond security breaches. Water sensors identify flooding that could damage servers or documents, while temperature monitors alert staff to HVAC failures that might compromise sensitive equipment.

The real power of multi-layer security comes from integration. When all systems communicate with each other, they create a comprehensive security ecosystem that’s much more effective than individual components working in isolation.

When an access card reader detects an after-hours entry attempt, it can automatically trigger cameras to focus on that area while alerting security personnel. If multiple failed access attempts occur, the system can lock down additional areas and require higher-level authorization for any access.

Integration also enables more sophisticated threat detection. If someone uses a valid access card but behaves unusually according to video analytics, or if network traffic patterns change immediately after a physical access event, integrated systems can identify potentially compromised credentials or insider threats.

Pittsburgh’s financial institutions serve diverse communities from busy urban centers to growing suburban areas. A security breach at any location can damage customer trust and result in significant financial losses. Single-point security solutions create vulnerability because criminals only need to overcome one barrier to achieve their objectives.

Multi-layer security ensures that even if criminals bypass one security measure, additional layers remain in place to prevent or limit damage. This redundancy is essential for maintaining customer confidence and regulatory compliance.

Banking regulations require specific security measures that often mandate multi-layered approaches. Federal guidelines specify requirements for physical security, data protection, and access controls that work together to create comprehensive protection.

Compliance reporting is much easier when integrated security systems automatically generate detailed logs and reports. Rather than manually collecting data from multiple standalone systems, integrated platforms provide comprehensive audit trails that demonstrate regulatory compliance.

While multi-layer security requires significant investment, the cost of security breaches far exceeds implementation expenses. A single successful attack can result in stolen funds, regulatory fines, legal costs, and long-term damage to customer relationships.

Comprehensive security systems also reduce insurance costs and operational expenses. Many insurance companies offer premium discounts for financial institutions with robust security measures, while automated systems reduce the need for additional security personnel.

Every financial institution has unique security requirements based on location, size, customer base, and services offered. Downtown Pittsburgh banks face different challenges than suburban branches, while credit unions have different needs than large commercial banks.

Professional security assessments identify specific vulnerabilities and recommend appropriate solutions. This ensures that security investments address actual risks rather than generic threats that might not apply to specific situations.

Working with experienced security professionals ensures proper system design and installation. TN Security Pittsburgh specializes in comprehensive commercial security solutions for financial institutions throughout the Pittsburgh area. With extensive experience in banking security requirements, TN Security can design and install integrated multi-layer systems that provide maximum protection while meeting regulatory compliance requirements.

Pittsburgh banks that haven’t yet implemented comprehensive multi-layer security systems face increasing risks as threat sophistication continues advancing. The question isn’t whether to invest in better security, but how quickly institutions can implement effective protection.

Starting with a professional security assessment identifies immediate vulnerabilities and prioritizes improvements based on risk levels and available budgets. Phased implementation allows banks to spread costs over time while addressing the most critical security gaps first.

For Pittsburgh financial institutions ready to enhance their security posture, TN Security Pittsburgh provides expert consultation and implementation services. Located at 3287 Library Road in Pittsburgh, TN Security has extensive experience designing custom security solutions for banks and financial institutions throughout Pennsylvania. Their team understands the unique challenges facing Pittsburgh’s banking sector and can recommend solutions that provide maximum protection within available budgets.

Contact TN Security Pittsburgh at 412-967-0467 or sales@teamnutztechnology.com to schedule a comprehensive security assessment. Don’t wait until a security incident forces reactive measures: proactive multi-layer security implementation protects your institution, your customers, and your reputation in Pittsburgh’s competitive banking environment.