Running a business in Pittsburgh comes with plenty of expenses, and commercial insurance premiums can take a significant bite out of your bottom line. What many business owners don’t realize is that installing comprehensive security systems Pittsburgh PA can dramatically reduce those insurance costs while simultaneously protecting their assets.

Insurance companies reward businesses that take proactive steps to minimize risk, and modern security systems represent one of the most effective ways to demonstrate that commitment. The numbers speak for themselves: businesses with professional security installations routinely see insurance premium reductions of 10-20%, with some achieving even greater savings depending on their industry and risk profile.

Insurance companies are fundamentally in the business of managing risk. When they calculate your commercial insurance premiums, they’re assessing the likelihood of having to pay out claims for theft, vandalism, property damage, and business interruption. Security systems Pittsburgh PA directly address these concerns by creating multiple layers of protection that make incidents less likely to occur and less costly when they do happen.

The relationship works on three levels: prevention, early detection, and loss limitation. Prevention occurs when visible security measures deter potential criminals from targeting your business in the first place. Early detection systems catch problems quickly, allowing for rapid response that minimizes damage. Loss limitation happens when security measures contain the scope of an incident, preventing small problems from becoming major losses.

Not all security systems are created equal when it comes to insurance benefits. Insurers pay particular attention to certain types of technology and installation standards that demonstrate genuine risk reduction.

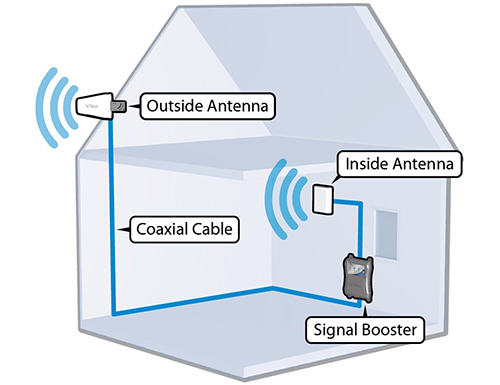

Commercial CCTV Systems represent the foundation of most insurance-friendly security packages. High-definition cameras with remote monitoring capabilities not only deter criminal activity but also provide crucial evidence that can help resolve claims quickly. Modern IP camera systems offer features like motion detection, night vision, and smartphone accessibility that insurance companies particularly value.

Intrusion Detection Systems provide immediate alerts when unauthorized entry occurs. These systems work around the clock, detecting break-ins through door and window sensors, motion detectors, and glass-break sensors. The faster an intrusion is detected, the less time criminals have to cause damage or steal property.

Access Control Systems give businesses precise control over who can enter specific areas and when. Key card systems, biometric readers, and smart locks create audit trails that insurance companies appreciate because they demonstrate systematic security management and help identify how breaches occur.

Professional Monitoring Services often provide the biggest insurance discounts because they ensure 24/7 oversight of your security systems. When an alarm triggers, trained professionals immediately assess the situation and contact law enforcement or emergency services as needed. This rapid response capability significantly reduces potential losses.

The financial benefits of security systems Pittsburgh PA extend far beyond theoretical calculations. Local businesses across the Pittsburgh metropolitan area have documented substantial insurance savings after implementing comprehensive security measures.

A manufacturing facility in the Strip District saw their annual insurance premiums drop by $8,000 after installing a complete security package including surveillance cameras, access control, and monitored alarms. The system cost $15,000 to install, meaning it paid for itself in less than two years through insurance savings alone.

A retail chain with multiple Pittsburgh locations negotiated a 15% reduction in premiums across all properties after standardizing their security systems. The company worked with their insurance carrier to identify specific security requirements that would qualify for maximum discounts, then implemented those features systematically.

Office buildings and commercial complexes often see the largest percentage savings because their insurance policies typically cover higher property values and business interruption risks. A Downtown Pittsburgh office building reduced annual premiums by $12,000 after upgrading to a modern access control system with integrated surveillance.

While immediate premium reductions grab attention, security systems Pittsburgh PA provide additional insurance-related benefits that compound savings over time.

Claims Prevention represents the most significant long-term benefit. Every prevented break-in, theft, or vandalism incident keeps your claims history clean. Insurance companies track claims frequency and severity when calculating renewals, so businesses with security systems often qualify for better rates year after year.

Faster Claims Resolution occurs when security systems provide clear documentation of incidents. High-quality surveillance footage and detailed access logs help insurance adjusters process claims quickly, reducing business interruption and getting you back to normal operations faster.

Enhanced Coverage Options become available to businesses that demonstrate strong security practices. Some insurance companies offer specialized policies with better terms and coverage limits for businesses that meet specific security standards.

Risk Assessment Improvements happen when businesses use security system data to identify and address vulnerabilities. Modern systems provide detailed reporting that helps business owners understand their risk patterns and make informed decisions about additional protective measures.

Pittsburgh’s unique geography and business environment create specific security challenges that impact insurance rates. The city’s numerous bridges, rivers, and varied neighborhoods mean that crime patterns and emergency response times vary significantly by location.

Businesses in areas like the Cultural District, Strip District, and Lawrenceville may face different risk profiles than those in suburban office parks or industrial areas. Security systems Pittsburgh PA need to account for these local factors to maximize both protection and insurance benefits.

Weather-related risks also play a role in Pittsburgh commercial insurance rates. Security systems that include environmental monitoring for flooding, temperature fluctuations, and power outages can help reduce claims related to the region’s varied weather patterns.

To maximize insurance savings from security systems Pittsburgh PA, businesses need to work proactively with their insurance carriers and security providers. The process typically begins with a risk assessment that identifies specific vulnerabilities and corresponding insurance concerns.

Many insurance companies have preferred security vendors or specific technology requirements that qualify for maximum discounts. Understanding these requirements before purchasing equipment ensures that your investment delivers the intended insurance benefits.

Documentation plays a crucial role in securing and maintaining insurance discounts. Businesses need to provide detailed information about their security systems, including equipment specifications, monitoring arrangements, and maintenance schedules. Regular system testing and updates may be required to maintain discount eligibility.

TN Security Pittsburgh has extensive experience working with local businesses and their insurance providers to design security solutions that maximize both protection and cost savings. Located at 3287 Library Road, Pittsburgh, PA 15234, our team understands the specific requirements of major insurance carriers operating in the Pittsburgh market.

Successfully reducing insurance costs through security systems requires strategic planning that considers both immediate and long-term goals. The most effective approach typically involves phased implementation that allows businesses to realize insurance savings while managing upfront costs.

Phase One usually focuses on the most cost-effective security measures that qualify for immediate insurance discounts. Basic alarm systems and entry-level surveillance often provide the best return on investment during the initial implementation.

Phase Two can expand into more sophisticated systems like access control and advanced analytics as the business grows and insurance savings accumulate. This approach allows the security system to essentially pay for its own expansion through reduced insurance premiums.

Phase Three might include specialized features like integrated fire detection, environmental monitoring, or advanced video analytics that address specific risks identified through the initial phases.

The team at TN Security Pittsburgh works closely with business owners to develop implementation strategies that align with their budgets, operational needs, and insurance requirements. Our experience with Pittsburgh-area businesses means we understand the local challenges and opportunities that impact security system effectiveness.

Smart business owners track the complete financial impact of their security systems Pittsburgh PA, not just the immediate insurance savings. A comprehensive ROI calculation should include premium reductions, prevented losses, improved operational efficiency, and enhanced employee safety.

Many businesses discover that their security systems provide returns that extend far beyond insurance savings. Reduced employee theft, improved inventory control, and enhanced customer confidence all contribute to the bottom line in ways that may not be immediately obvious.

Regular review of insurance policies and security system performance ensures that businesses continue to maximize their investment. As technology evolves and business needs change, periodic updates to both systems and insurance coverage can maintain optimal cost savings and protection levels.

For businesses ready to explore how security systems Pittsburgh PA can reduce their insurance costs, TN Security Pittsburgh offers comprehensive consultations that include insurance savings analysis. Contact our team at 412-967-0467 or email sales@teamnutztechnology.com to schedule an assessment that could start saving your business money immediately while providing the peace of mind that comes with professional security protection.

The investment in quality security systems pays dividends that extend far beyond the immediate insurance premium reductions, creating a foundation for long-term business success in Pittsburgh’s dynamic commercial environment.